Origins and Core Concept

Satoshi Nakamoto revolutionized finance by creating Bitcoin, the world’s first cryptocurrency. The project emerged from a simple yet powerful idea: eliminating middlemen from financial transactions. Traditional online businesses relied heavily on central authorities and banking systems, but Bitcoin proposed a radical alternative—a peer-to-peer digital currency system operating without governmental oversight.

Technical Architecture

The Blockchain Foundation

Bitcoin operates on blockchain technology, a distributed ledger system that records all transactions chronologically in blocks. This digital ledger is:

- Open-source and freely accessible

- Distributed across a network of nodes

- Secured through complex mathematical algorithms

- Maintained through consensus mechanisms

Core Security Protocols

1. SHA-256 Protocol

The Secure Hashing Algorithm (SHA-256) serves as Bitcoin’s cryptographic backbone:

- Transforms input data into 256-bit hash values

- Protects sensitive information through encryption

- Authenticates transactions using digital signatures

- Generates user addresses

- Creates the Merkle root in block headers

2. Consensus Mechanisms

Proof of Work (PoW)

- Eliminates need for financial intermediaries

- Uses cryptographic principles for transaction verification

- Requires miners to solve complex mathematical puzzles

- Demands specialized hardware with high processing power

Proof of Stake (PoS)

- Developed as an energy-efficient alternative to PoW

- Requires users to “stake” crypto assets

- Selects validators based on stake size and time invested

- Reduces overall power consumption

3. Nonce (“Number Only Used Once”)

- Random number used once in cryptographic hashing

- Critical component in block validation

- Must satisfy difficulty requirements set by consensus mechanisms

- Key mathematical challenge for miners

Bitcoin Mining Explained

The Mining Process

- Transactions are allocated to miners for processing

- Miners use SHA-256 to solve computational puzzles

- Solutions are verified by the network

- Successful miners receive block rewards

- Block rewards halve periodically (started at 50 BTC, reduces by half)

- Maximum supply capped at 21 million bitcoins

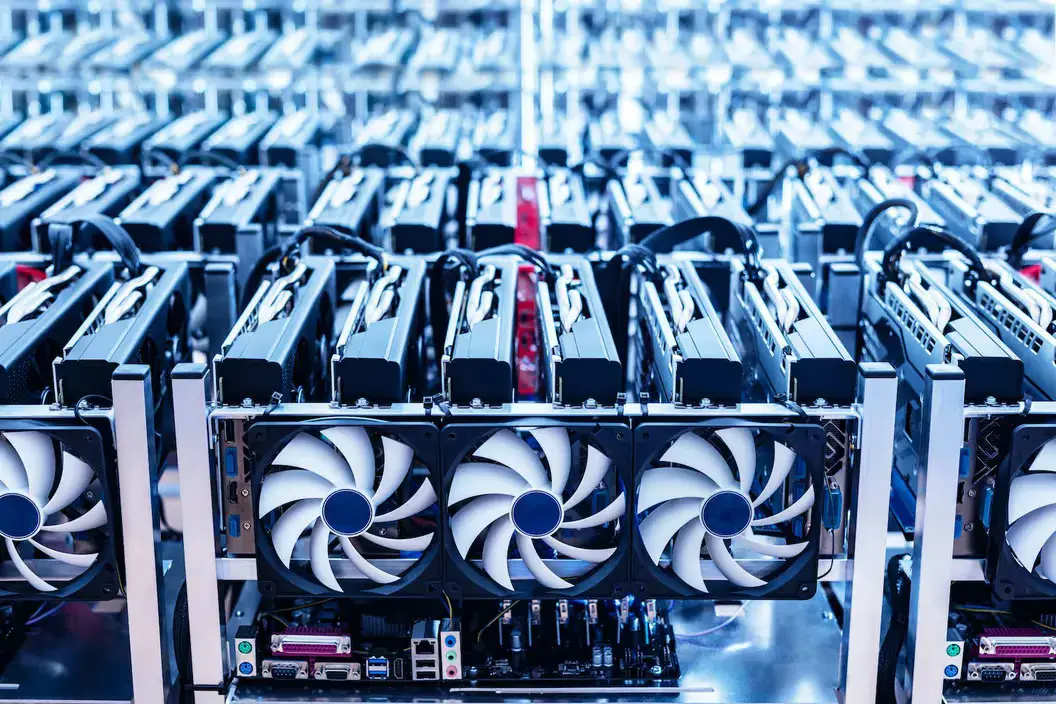

Mining Equipment Evolution

CPU Mining

- Originally used standard computer processors

- Now inefficient for Bitcoin mining

- Still viable for some alternative cryptocurrencies

- Low hash rates and high power consumption

ASIC Mining

- Application-Specific Integrated Circuits

- Purpose-built for cryptocurrency mining

- Offers superior hash rates

- More energy-efficient

- Expensive but more profitable

- Limited to specific cryptocurrencies

Mining Pools

Mining pools emerged as a solution for individual miners to compete effectively:

- Combine computing power of multiple miners

- Share rewards proportionally

- Managed by pool operators

- Require proof of work from participants

- Distribute rewards based on contribution

- Increase chances of earning Bitcoin for smaller miners

Security Measures

Double-Spending Prevention

- Early concern in digital currency

- Solved through consensus protocols

- Network-wide transaction verification

- Continuous monitoring by all participants

Smart Contracts

- Automated agreement execution

- Pre-programmed conditions

- Network-wide verification

- Eliminates need for intermediaries

Environmental Impact

Bitcoin mining’s computational requirements lead to:

- High energy consumption

- Significant carbon footprint

- Environmental concerns

- Push for more efficient alternatives

Conclusion

Bitcoin’s revolutionary approach to digital currency relies on sophisticated mathematical principles and cryptographic protocols. While the system has proven secure and effective, it continues to evolve, particularly regarding energy efficiency and accessibility. The interplay of consensus mechanisms, mining processes, and security protocols creates a robust financial system that operates independently of traditional banking structures.