Bitcoin Diamond (BCD): Understanding Bitcoin’s Enhanced Fork

Introduction to Bitcoin Diamond

Bitcoin Diamond (BCD) emerged as a hard fork of Bitcoin, designed to address several limitations of the original cryptocurrency. Key objectives include:

- Enhanced transaction speed

- Reduced fees

- More accessible mining

- Improved data privacy

- Greater scalability

Origins and Development

Creation

- Launch Date: November 24, 2017

- Fork Block: 495,866

- Developers: Team Evey and Team 007 (anonymous)

- Initial Distribution: 10 BCD for each BTC held at fork

Development Team

- Anonymous developers following Bitcoin’s tradition

- Two teams: Team Evey and Team 007

- Focus on scalability and accessibility

Understanding Cryptocurrency Forks

Types of Forks

Accidental Forks

- Occur when miners solve blocks simultaneously

- Temporary chain splits

- Resolve naturally through longest chain rule

- Minor, self-correcting events

Intentional Forks

- Soft Forks

- Backward-compatible changes

- Optional upgrades

- Minor protocol modifications

- Hard Forks

- Major protocol changes

- Not backward compatible

- Requires universal upgrade

- Can result in new cryptocurrencies

Bitcoin Diamond vs Bitcoin: Key Differences

Technical Specifications

- Block Size

- BCD: 8MB blocks

- BTC: 1MB blocks

- Result: Higher transaction throughput for BCD

- Mining Algorithm

- BCD: X-13 algorithm

- BTC: SHA-256

- Benefit: GPU mining capability for BCD

- Supply Metrics

- BCD Total Supply: 210,000,000

- BTC Total Supply: 21,000,000

- Ratio: 10:1 BCD to BTC

Mining Characteristics

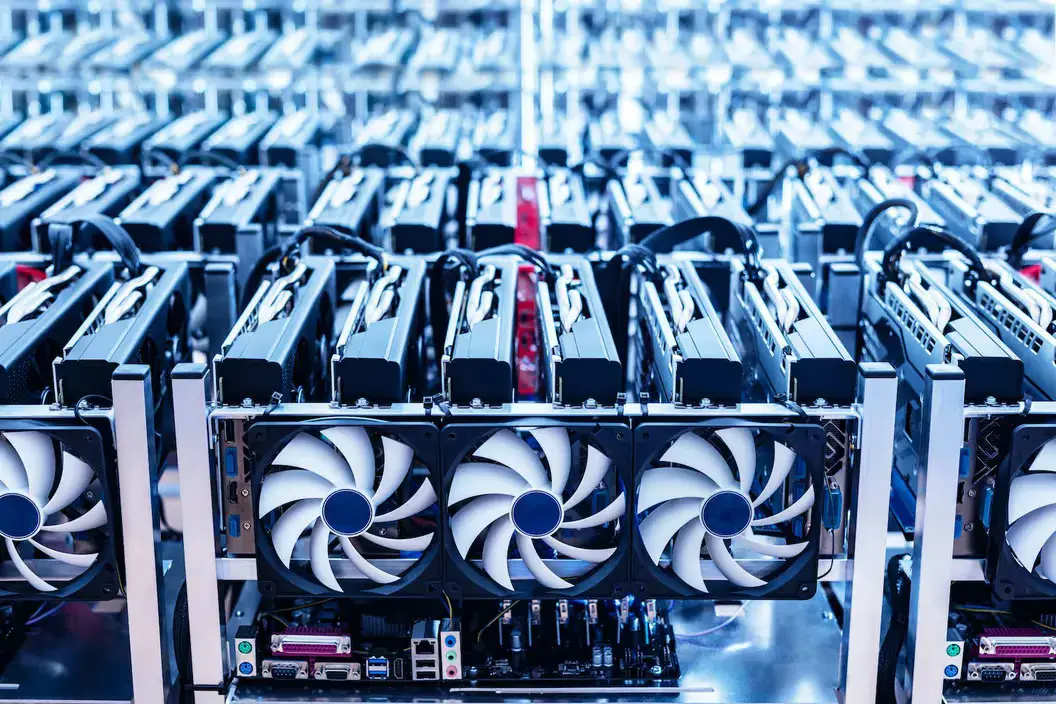

- Hardware Requirements

- Supports GPU mining

- More accessible than ASIC mining

- Lower barrier to entry

- Home mining viable

- Mining Pools

- Community-based mining

- Shared resources

- Better for beginners

- Distributed rewards

Acquiring Bitcoin Diamond

Trading Platforms

Major exchanges listing BCD:

- Binance (Highest volume – 83%)

- OKEx

- HitBTC

- Huobi Global

- KuCoin

Purchase Methods

- Direct fiat currency pairs (USD, IDR, KRW)

- Cryptocurrency pairs (BTC, USDT, ETH)

- Exchange-specific requirements vary

Storage Recommendations

- Secure wallet storage recommended

- Private key management crucial

- Multiple wallet options available

Technical Advantages

Scalability

- Larger block size

- Higher transaction capacity

- Faster processing

- Reduced network congestion

Accessibility

- GPU mining support

- Lower hardware costs

- Broader participation possible

- Community-focused approach

Transaction Efficiency

- Reduced fees

- Faster confirmations

- Enhanced throughput

- Better user experience

Market Position

- Among top 5 Bitcoin forks

- Competes with:

- Bitcoin Cash (BCH)

- Bitcoin Gold (BTG)

- Bitcoin Interest (BCI)

- Bitcoin Private (BTCP)

Conclusion

Bitcoin Diamond represents a significant evolution in the Bitcoin ecosystem, offering solutions to several limitations of the original Bitcoin protocol. Its focus on accessibility, scalability, and efficiency makes it an interesting alternative for users seeking improved cryptocurrency functionality. While maintaining Bitcoin’s core principles, BCD introduces important technical innovations that enhance its utility for both miners and users.

The project demonstrates how cryptocurrency forks can lead to meaningful technological improvements while maintaining the fundamental principles of decentralization and security that made Bitcoin revolutionary.